republic onboarding

Internet Banking

-

Savings & Chequing

-

Savings Accounts

Growing up with a plan for tomorrow

For youths between the ages 13 to 19 years

Shape your future

Helps you to build your nest egg

Saves you time and money

The wise investment instrument

Earn more on your Foreign Accounts

Chequing Accounts

Bank FREE, easy and convenient

A world of convenience and flexibity

Invest and enjoy the best of both worlds

A value package designed for persons 60 +

Life Stage Packages

Banking on your terms

Getting married?

Tools & Guides

Make an informed decision using our calculators

Help choose the account that’s right for you

All Our Cheques Have A New Look!

-

-

Electronic Banking

-

EBS Products

Open a deposit account online

Pay bills and manage your accounts easily

Banking on the Go!

Welcome to the Cashless Experience

Top up your phone/friend’s phone or pay utility bills for FREE!

EBS Products

Make secure deposits and bill payments

Access your accounts easily and securely with the convenience of Chip and PIN technology and contactless transactions.

Access cash and manage your money

Where your change adds up

-

-

Credit cards

-

Credit Cards

Credit Cards

Additional Information

-

-

Prepaid Cards

-

Pre-paid Cards

-

-

Loans

-

overview

To take you through each stage of life, as we aim to assist you with the funds you need for the things you want to do

We make it easy to acquire financial assistance for tertiary education through the Higher Education Loan Programme

We make it easy, quick and affordable to buy the car of your dreams

Tools & Guides

Helps you determine the loan amount that you can afford

You can calculate your business’ potential borrowing repayments

Republic Bank's Group Life Insurance will provide relief to your family by repaying your outstanding mortgage, retail or credit card balance in the event of death or disablement.

-

-

Mortgages

-

Mortgage Centre

Republic Bank Limited can make your dream of a new home a quick and affordable reality

New Customers

Block for MM- new user mortgage process

There are three stages you must complete before owning your first home

Tools & Guides

block for MM - personal - mortgages

-

-

Investments

-

Investment Products

-

Banking in the time of Covid-19

You are here

Home / Banking in the time of Covid-19

I wrote in my previous blog that “2020 has been a year of change and not in the way many of us envisioned. As COVID-19 has spread across the globe, we’ve seen rapid changes across the board. It’s a virus that doesn’t discriminate and it has pushed us all, business and personal alike, to reevaluate our daily routines.” Since then, the consequences of this pandemic continue to permeate throughout the globe. All sectors of the economy have been affected in some form or another, many of them detrimentally. Evaluating the real-time data and charting a safe and sustainable way forward is now an overarching priority for all major industries.

The banking sector (including Fintechs) has gone through an abrupt upheaval over the course of the pandemic, the long-term impact of which is still being debated and determined. The way transactions are conducted has changed virtually overnight. Additionally, corporate, commercial and retail customer behaviour has shifted dramatically to one of caution. Businesses have weathered shutdowns and persons have endured shorter working hours or a loss of income altogether, leading to higher risk aversion and a reduction in spend. The traditional banking model is flawed in the current COVID world, the management of which McKinsey explores in depth here.

Digital transformation in banking has been an ongoing conversation and challenge for many years. Internationally, the emergence of online payment services and alternative channels has disrupted the competitive landscape. The added layer of financial regulations and concerns about cybersecurity have further mounted that pressure. While the former hasn’t been fully realized locally and regionally, the latter is a mainstay of the industry. At home, banking has remained a predominantly in-person service until the pandemic. The past introduction of channels like online and mobile banking was a right step in the digital direction, however, there needs to be a greater emphasis on innovating the banking model for a post-COVID environment. Customers have been affected in many ways and it is our societal responsibility to develop agile responses that fit those new and evolving needs.

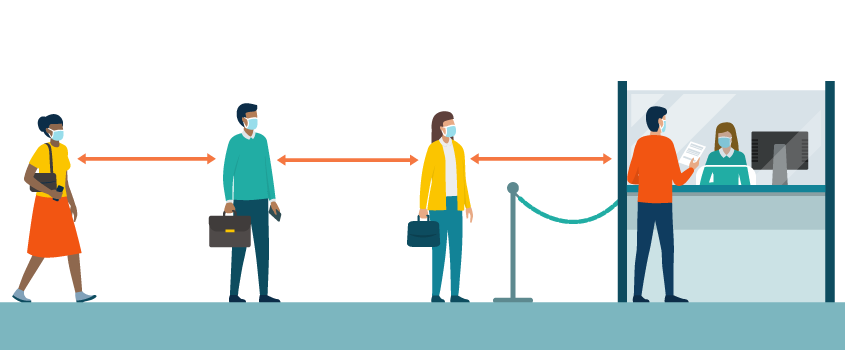

This goes well beyond social and physical distancing. The reduction of in-branch traffic means that communication and customer service efforts must be clear and accessible, and digital adoption made more conventional. Deloitte’s whitepaper, Consumer Banking Remade by COVID-19, says, “The evolution toward direct sales, self service, digital advice, and digital payments has been accelerated over a few short weeks as social distancing has necessitated full scale digital adoption. Even customers who were reluctant to adopt digital interactions have done so out of necessity, gaining some level of comfort with these new methods. Financial institutions are rapidly adjusting to serving customers almost entirely digitally with leading players proactively investing in expanding the functionality and efficiency of their digital platforms in the short- and long-term…”

In 2019, Republic Bank piloted a contactless, wearable payment solution at the Hero CPL Final, the first of its kind at a Caribbean sporting event. It was received with praise from patrons as quick, safe, and reliable. Implementing these kinds of technologies on a broader scale and having them become day-to-day staples is part of the future of banking within the region. Other digital tools, from advanced ATM and self-serve options at branches to a greater range of online alternatives such as digital assistants, are more than the way forward for our emerging markets. As PWC says in their research on COVID-19 and banking, “Banks will need to respond to lasting social changes, including how consumers select channel preferences, products, and banks for their individual financial needs, that are likely to result from the current crisis.” With the social and economic disruption caused by the pandemic, these technologies and tools will become mandatory buffers in such times.

Creating end-to-end digital solutions for customers – solutions that are personalized, convenient and safe - is only part of the strategy overhaul that banks will need to undertake for the remainder of 2020 and onwards. Crisis management isn’t a nice-to-have. The pandemic has not only shown the weaknesses within the system but the capabilities that are present to correct them. Recognizable macro-economic threats are now joined by unprecedented ones and the resiliency of banking or any sector relies on analyzing, understanding, and planning for the latter.

COMPANY INFORMATION

Banking Segments

Press & Media

Contact Us

© 2025 Republic Bank Limited. All Rights reserved.

Richard Sammy

Richard Sammy